san francisco payroll tax withholding

The city of San Francisco levies a gross receipts tax on the payroll expenses of large businesses. Appointed in 2004 and first elected in 2005 Cisneros.

Local Income Taxes City And County Level Income And Wage Taxes Continue To Wane Tax Foundation

In certain circumstances the business fails to collect or remit part or all of the withheld.

. If you take the components of the SF GRT 200M gross receipts 50 payroll in SF and the relevant GRT rate the current GRT and Payroll tax will come out to approximately. As Treasurer he serves as the Citys banker and Chief Investment Officer managing all tax and revenue collection for San Francisco. Earned Income Tax Credit Notices.

Effective January 1 2022 businesses subject to the San Francisco Administrative Office Tax AOT must pay an additional annual Overpaid Executive Tax OET of 04 to 24. Until 2018 all businesses with a taxable San Francisco payroll expense greater than 150000 must file a Payroll Expense Tax Statement for their. We offer reliable services for W-2 Federal Tax Forms in San Francisco California.

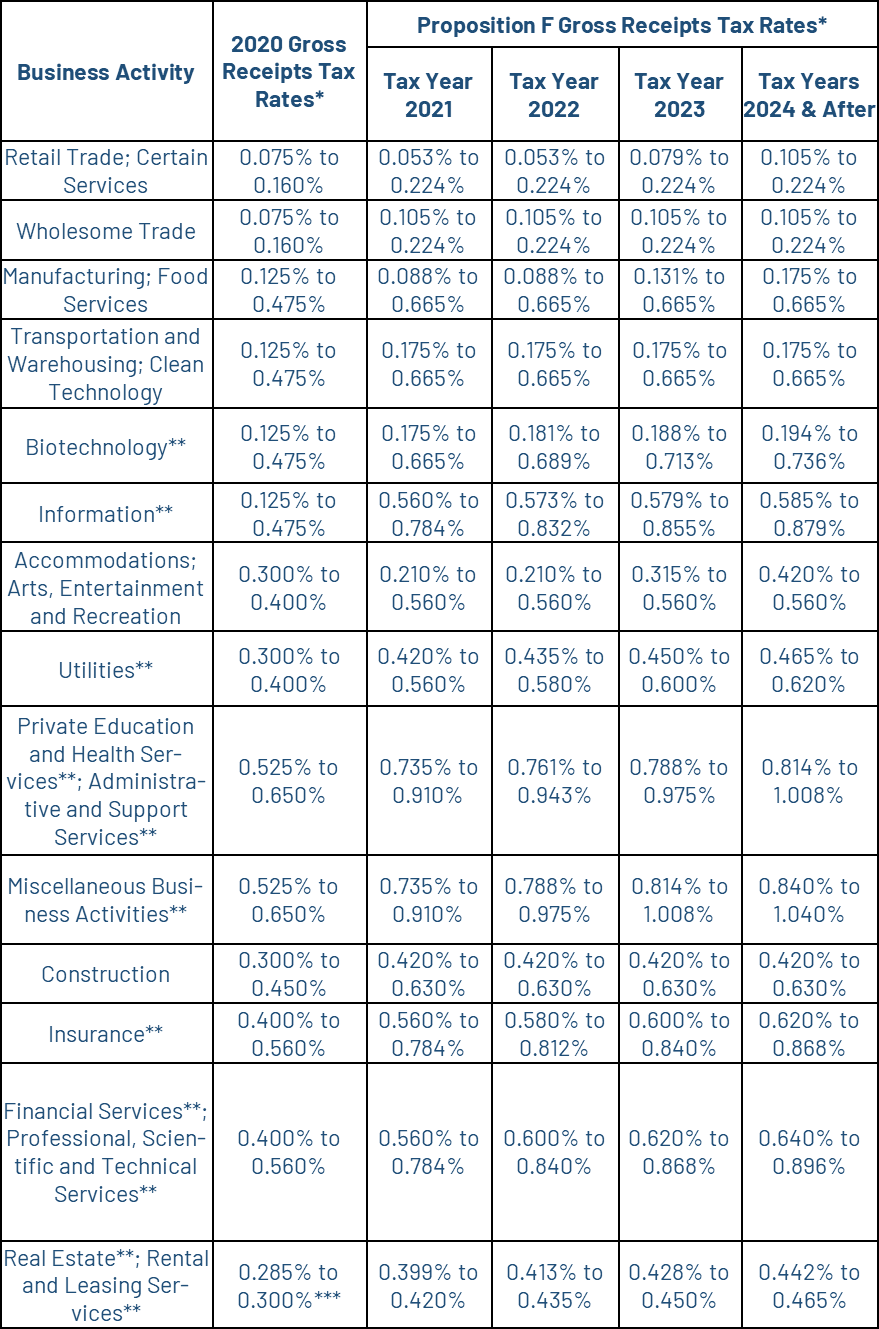

Payroll Expense Tax PY Proposition F was approved by San Francisco voters on November 2 2020 and became effective January 1 2021. Based on where the employee works whether resident or non-resident. 56 open jobs for Withholding tax manager in San Francisco.

Administration Finance. PAYROLL EXPENSE TAX ORDINANCE Sec. See Form W-2 Requirements.

Treasurer Tax Collector City and County of San Francisco. Unfortunately sometimes the payroll tax withholding process breaks down on a case by case level. Gross Receipts Tax and Payroll Expense Tax.

Employers must keep the same records for state income tax purposes as is required to be kept for federal income tax. The Administration Finance Division is our internal support division serving over 300 Controllers Office employees in two locations. After serving as a business reporter and editor she wrote the Net Worth column from 2000 to 2021.

Search Withholding tax manager jobs in San Francisco CA with company ratings salaries. Select or make changes to your tax withholding status for federal and state taxes by completing the. Get a FREE customized payroll and payroll tax services quote today.

W-2 Wages and Withholding. Payroll Expense Tax. Kathleen Pender was a San Francisco Chronicle journalist for 36 years.

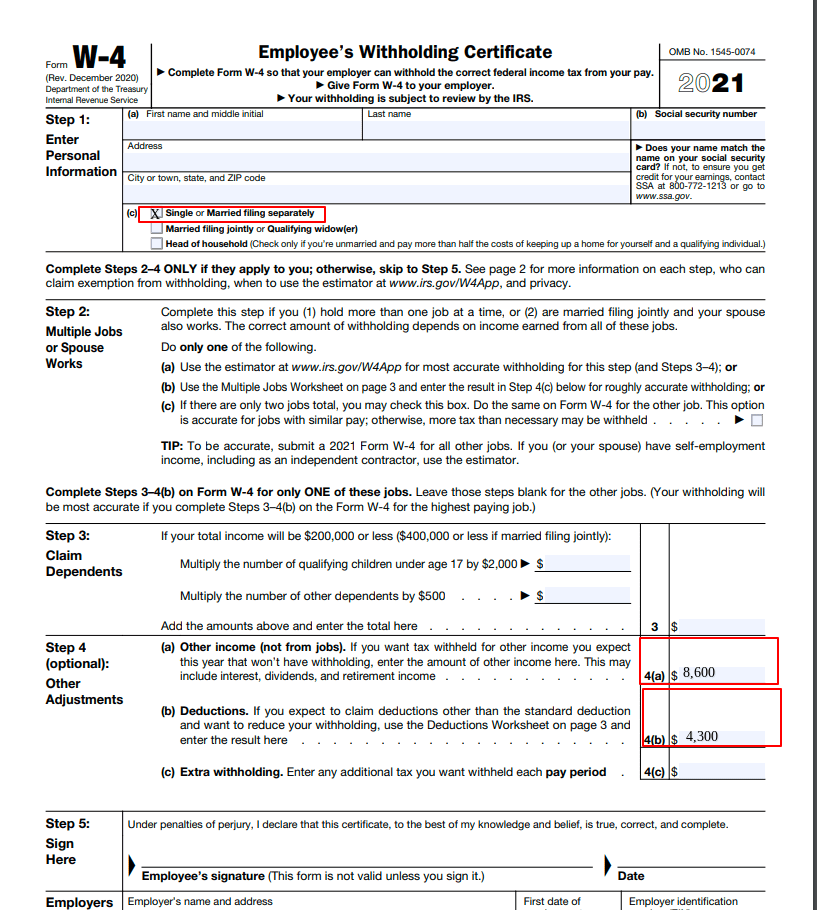

Review the Update My Federal Withholding W-4 and Update My California Tax Withholding DE-4 software. Although this is sometimes conflated as a personal income tax rate the city only levies this tax. Federal and State tax.

Proposition F fully repeals the Payroll Expense. Apply to Payroll Manager Tax Manager Senior Payroll Accountant and more. UCSF employees now use UCPath online to complete and submit tax forms.

San Francisco Business and Tax Regulations Code ARTICLE 12-A. Lean more on how to submit these installments online to. Pay online the Payroll Expense Tax and Gross Receipts Tax quarterly installments.

For more information about San Francisco 2021 payroll tax withholding please call this phone number. Gusto partners with CorpNet to help you register in the statelearn more below. Click Register a company with the state on your own or Find account numbers and rate infothe company is.

Payroll Tax Manager Resume Samples Velvet Jobs

2022 Federal State Payroll Tax Rates For Employers

Annual Business Tax Returns 2019 Treasurer Tax Collector

Fringe Benefits Rules For 2 S Corp Shareholders Cares Act Changes

Trump Payroll Tax Holiday How It Affects Paychecks In 2021 Money

Trump S Proposed Payroll Tax Elimination Itep

Payroll Tax Accountant Resume Samples Velvet Jobs

Payroll Tax What It Is How To Calculate It Bench Accounting

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

State Payroll Taxes Guide For 2020 Article

Are Federal And State Taxes Withheld As A Percentage Of Your Pay In The Us Quora

Gross Receipts Tax Gr Treasurer Tax Collector

Can I Set Up A Payment Plan For Unpaid Payroll Taxes

Restricted Stock Units Jane Financial

Different Types Of Payroll Deductions Gusto

The Tax And People Implications Of A Remote Workforce Bdo

Us Payroll And Taxes The Complete Guide To Running Payroll In The Usa